What is Leverage in Trading?

Leverage allows traders to enter positions with more money than they have in their brokerage account. Each broker will offer certain leverage limits, which are typically displayed as a ratio.

- For example, let’s say that the broker offers leverage of 1:10.

- If the trader stakes $50 at 1:10, this amplifies the value of the position to $500.

- As such, if the trader makes gains of 20% on this position, they will make $100 ($10 x 10) as opposed to just $10 (20% of $50 stake).

The main concept of leverage trading is that it allows investors to access a much higher level of capital.

This is especially important when trading forex, as price movements are often very small in percentage terms. Therefore, this can make it difficult to make an attractive amount of money with a small capital outlay.

Lever limits are dependent on several factors, such as:

- The country of residence that the trader lives

- The asset class

- The broker

- Whether the trader is a retail or professional client

While leverage does offer the ability to amplify investment gains, it can do the same with losses. As such, beginners should tread carefully when applying leverage for the first time.

High Leverage Definition

Whether or not the amount of leverage available to a trader is deemed ‘high’ is subjective. With that said, if the trader is based in a country where clear limits exist, anything above this level might be considered high.

For example, traders in the UK, Europe, and Australia are capped to a maximum leverage ratio of 1:30 when trading major forex pairs, and less on other assets.

This is due to regulatory guidelines set by the ruling financial authority such as the UK’s FCA. Nonetheless, should the trader find a broker that offers higher limits than 1:30, this would be considered a high leverage platform.

It is important to note that when searching for the best forex brokers with high leverage, traders should ensure that the platform is adequately regulated.

That is to say, there are many offshore brokers that offer leverage limits above and beyond the 1:30 level, but whether or not the investment capital is safe remains to be seen.

Benefits of Trading with High Leverage

The main benefits of trading with high lever are discussed below:

Ideal for Traders on a Budget

Leverage is highly suitable for skilled traders that wish to make a living from their investment endeavors but do not have a suitable amount of capital.

- For instance, let’s say that a trader is able to make average gains of 4% per month over the course of a year.

- While at first glance this is an impressive feat, an initial starting balance of just $500 would not make the process worthwhile.

- After all, in real terms, this amounts to a monthly profit of just $20.

However, let’s then say that the trader utilizes lever of 1:30 on each and every trade. In the same scenario, this would boost the monthly profit to $600.

Suitable for Low Volatility Markets

Another benefit of trading with leverage is that it is highly suitable for low volatility markets. For instance, major forex pairs like EUR/USD rarely move by more than 1-2 in a single day of trading.

Unlike stocks, the aim isn’t for a currency pair to increase in value indefinitely. Instead, currencies typically go through trends and cycles which can be both bullish and bearish.

The key point here is that it can be difficult to make worthwhile profits from low-volatility markets. But, when implementing leverage, this can turn a small gain into a highly sizable profit.

Great for Low-Risk, High-Profit Trades

The best high leverage brokers offer negative balance protection. This means that when trading with leverage, the user can never lose more than they have in their brokerage account.

And therefore, this makes leverage ideal for targeting low-risk, high-profit trades.

- For example, let’s say that the trader stakes $100 with leverage of 1:1000.

- This turns the $100 position into trading capital of $100,000.

As per the above, only two things can happen. Either the trade results in a maximum loss of $100 or gains are multiplied by a factor of 1,000x.

Risks of Trading with High Leverage

The main risks of trading with high leverage are discussed below:

Liquidation

The most obvious risk of trading with lever is that the position can be liquidated. This will happen when the position declines in value by a certain amount.

For example, let’s say that leverage of 1:20 is added to a stake of $100. This means that with a stake of just $100, the trader places a position worth $2,000. This amounts to just 5% of the trading position.

Therefore, if the trade declines by 5%, the broker will be forced to liquidate the position and the trader will lose their $100 stake.

Most Leverage Traders Lose Money

By visiting a high lever trading platform that specializes in CFDs, a risk warning is typically displayed. This informs the user of the percentage of retail clients that end up losing money. More often than not, this figure is in the 70-80% region.

As such, a lot more traders lose money when accessing leveraged markets when compared to those that generate a consistent profit.

How to Trade with a High Leverage Broker

The guide below explains how to start trading assets right now with a high leverage broker.

For this tutorial, we explain the steps with eToro – which offers leverage on thousands of financial instruments.

Step 1: Open an eToro Account

First, visit the eToro website and create an account. This will require some personal information and contact details.

eToro will also ask for a copy of a passport or a driver’s license for verification purposes.

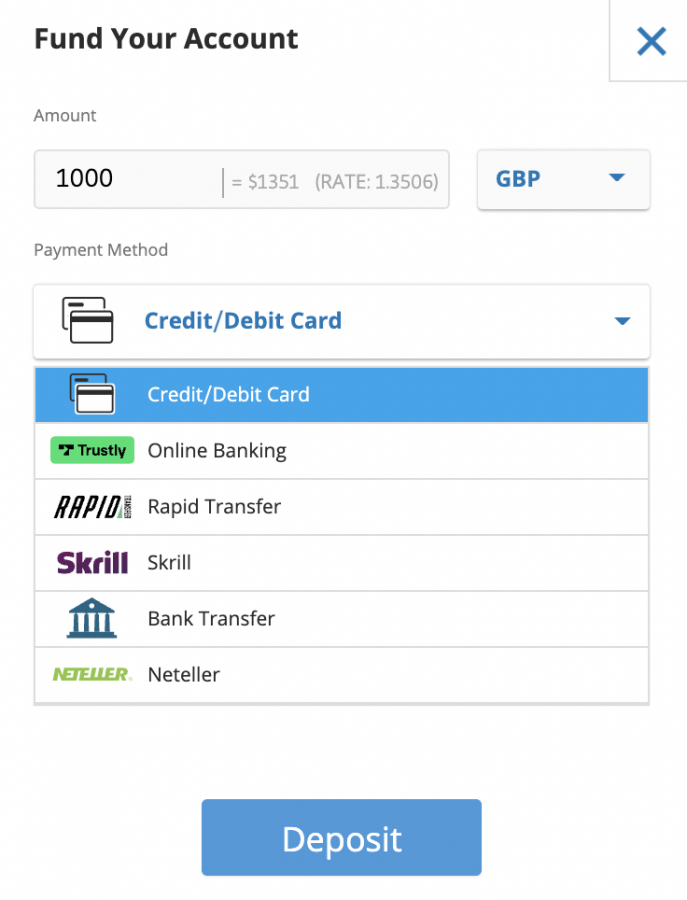

Step 2: Deposit Funds

Next, add some money to the newly created eToro account.

- A minimum of $10 is required when funding an account

No deposit fees are charged by eToro.

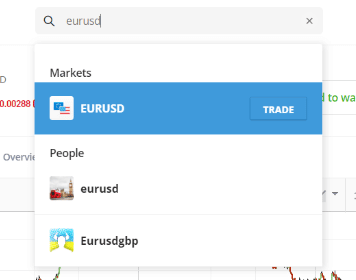

Step 3: Search for Asset

Next, use the search bar at the top of the page to find an asset to trade.

The above example highlights how to search for the forex pair EUR/USD.

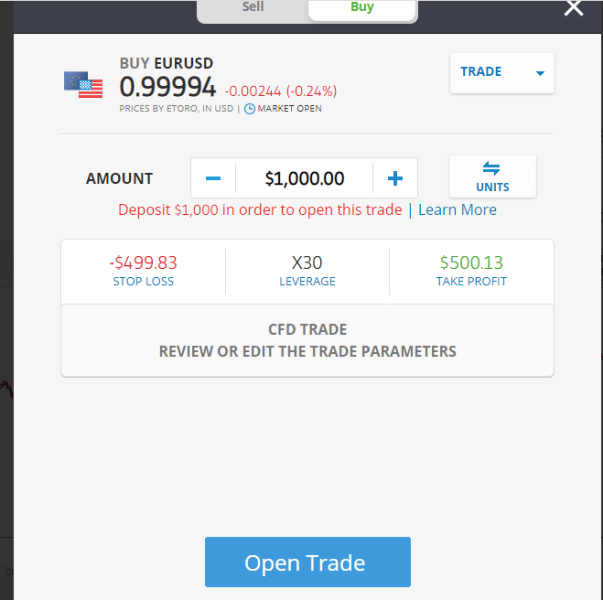

Step 4: Trade Forex

Finally, choose from a buy or sell order, depending on whether the trader thinks the asset will rise or fall in value.

Enter a stake and confirm the order.

Why Is Financial Leverage Important?

Financial leverage is important as it creates opportunities for investors. That opportunity comes with risk, and it is often advised that new investors get a strong understanding of what leverage is and what potential downsides are before entering levered positions. Financial leverage can be used strategically to position a portfolio to capitalize on winners and suffer even more when investments turn sour.