Introduction to XM Trading Platform

XM Trading, established in 2009 and headquartered in Limassol, Cyprus, is a globally recognized online trading platform. Over its more than a decade of operations, XM has expanded its presence worldwide, including offices in major cities such as London, Sydney, and Athens. The platform is known for its extensive marketing campaigns and broad global reach, which has attracted a diverse customer base from nearly 200 countries.

As of today, XM boasts impressive achievements:

- Over 3.5 million clients from 196 countries are actively using XM's services.

- More than 2.4 billion trades have been executed without any re-quotes or order rejections, ensuring a seamless trading experience.

- The platform handles an average daily trading volume of $15 billion, reflecting its high level of market activity.

- XM has established partnerships in 120+ cities across the globe, enhancing its international influence.

- The official website, XM.com, receives around 5 million visits per month, highlighting its popularity and robust online presence.

XM’s continuous growth and dedication to customer satisfaction have solidified its position as a leading player in the global trading industry. The platform’s commitment to transparency, reliability, and innovation has attracted millions of traders, making XM a trusted name in online trading.

Regulatory Licenses of XM

XM has earned a strong reputation in the global trading market, in part due to its compliance with some of the most respected regulatory bodies in the financial industry. This commitment to regulation ensures that XM operates with a high level of transparency and integrity across multiple regions. The platform holds several key licenses, which are considered top-tier in the industry:

- Cyprus Securities and Exchange Commission (CySEC): XM is licensed under CySEC with the license number 120/10, ensuring that it adheres to the strict financial regulations in Cyprus, providing a secure trading environment for European clients.

- Australian Securities and Investments Commission (ASIC): XM is also regulated by ASIC, under license number 443670, which allows it to operate in Australia while maintaining high standards of financial conduct and client protection.

- International Financial Services Commission (IFSC): XM holds a license from the IFSC with the license number IFSC/60/354/TS/18, enabling it to offer financial services to clients in regions governed by the IFSC, further broadening its global reach.

These licenses reflect XM's dedication to regulatory compliance and its commitment to providing a safe and reliable trading environment for its users worldwide.

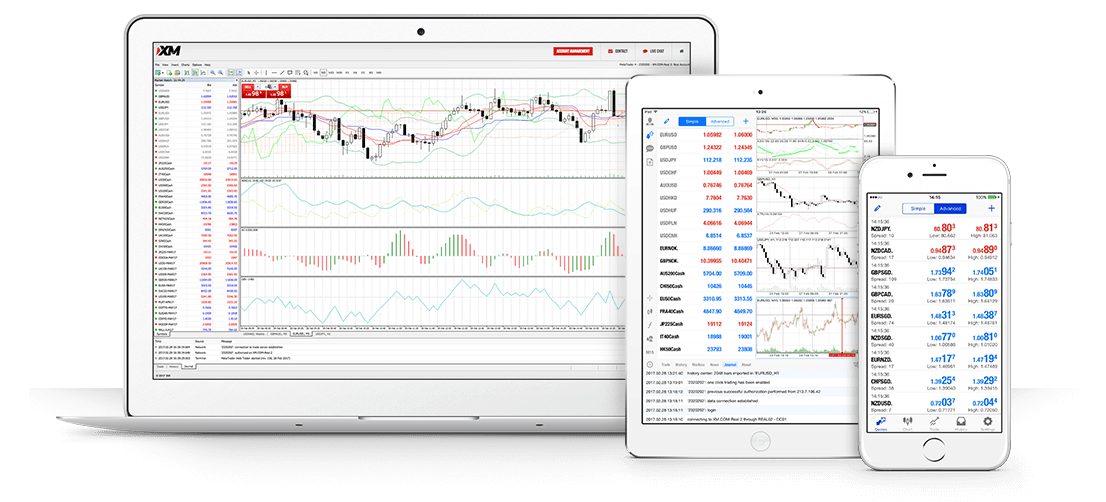

Trading Platforms Offered by XM

XM provides its traders with a variety of trading platforms, designed to meet the diverse needs of its global clientele. Whether you prefer trading on a desktop or on the go, XM ensures that you have access to cutting-edge technology and tools to facilitate your trading activities.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

XM supports both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which are among the most popular and widely used trading platforms globally. These platforms are available in multiple versions, ensuring compatibility across various devices:

- Desktop Versions: Both MT4 and MT5 are available for Windows and Mac, offering a robust suite of tools for advanced traders who prefer the detailed analysis capabilities available on a desktop computer.

- Mobile Versions: For traders who need flexibility, XM offers mobile versions of MT4 and MT5 for iOS (iPhone, iPad) and Android devices, allowing you to trade from anywhere at any time.

- Tablet Versions: The platforms are also optimized for use on Android Tablets and iPads, providing a larger interface while maintaining mobility.

MetaTader WebTrader

In addition to the downloadable platforms, XM offers the MetaTrader WebTrader, which allows you to trade directly from your web browser. The WebTrader platform provides full functionality similar to the desktop versions of MT4 and MT5, including access to real and demo accounts, without the need to download or install any software.

|

Platform |

Versions Available |

Key Features |

|

MetaTrader 4 |

Desktop, Mobile, Tablet |

Advanced charting, 30 indicators, 9 timeframes |

|

MetaTrader 5 |

Desktop, Mobile, Tablet |

Enhanced charting, 38 indicators, 21 timeframes |

|

Meta WebTrader |

Web-based |

No installation required, full trading functionality |

This suite of platforms ensures that XM’s clients can choose the trading environment that best suits their needs, whether they are looking for powerful desktop software, the flexibility of mobile trading, or the convenience of browser-based access.

Trading Products Offered by XM

XM is renowned for its diverse range of trading products, providing traders with ample opportunities to diversify their portfolios across various asset classes. Whether you are interested in forex, commodities, indices, or cryptocurrencies, XM has a comprehensive selection to meet your trading needs.

1. Forex Trading

Currency Pairs: XM offers 57 currency pairs, including majors, minors, and exotic pairs. With leverage up to 1:888 and spreads starting from 0.6 pips, forex trading on XM is designed to be cost-effective, with no commission fees on any account type.

2. CFD Stocks

Global Stocks: Traders can access CFDs on over 300 stocks from major companies worldwide. This allows for exposure to international markets without the need to directly purchase the underlying assets.

3. Commodities

Commodity Products: XM provides access to 8 major commodities, including coffee, wheat, sugar, corn, and cocoa. These products offer traders the chance to invest in essential goods that play significant roles in global markets.

4. Equity Indices

Indices: With about 30 indices available, including cash and futures indices like the S&P 500, Nasdaq 100, Dow Jones, Nikkei 225, and DAX, XM offers comprehensive coverage of global equity markets.

5. Metals

Precious Metals: XM offers trading in two key metals, gold and silver, with leverage up to 1:888. The spread for gold starts from just 0.3 pips, making it an attractive option for traders looking to invest in safe-haven assets.

6. Energies

Energy Products: XM includes 5 energy products, such as natural gas and crude oil, with competitive spreads starting at 0.03 for gas and 0.05 for oil, enabling traders to tap into the lucrative energy markets.

7. Shares

Stock Trading: With access to over 100 different stocks, XM allows traders to buy and sell shares from companies around the world. Trading fees for U.S. stocks are $0.04 per share with a minimum commission of $1. For UK and German stocks, the trading fee is 0.1% per transaction, with minimum commissions of $9 and $5, respectively.

8. Cryptocurrencies

Crypto Assets: XM offers trading in 5 popular cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and Bitcoin Cash (BCH). Crypto trading is available only on the MT5 platform with leverage up to 1:5 and fixed swap rates for long and short positions.

|

Product |

Details |

|

Forex |

57 currency pairs, leverage up to 1:888, no commission |

|

CFD Stocks |

300+ global stocks |

|

Commodities |

8 major commodities (e.g., coffee, wheat, sugar) |

|

Equity Indices |

30 indices including S&P 500, Nasdaq 100, Dow Jones |

|

Metals |

Gold, Silver, leverage up to 1:888 |

|

Energies |

5 energy products (e.g., gas, oil) |

|

Shares |

100+ stocks, competitive fees |

|

Cryptocurrencies |

5 cryptos (BTC, ETH, LTC, XRP, BCH), MT5 only |

XM's wide range of trading products ensures that traders can diversify their portfolios across multiple asset classes, catering to both short-term and long-term investment strategies.

Trading Fees, Leverage, Commission, and Spread at XM

For professional traders, particularly those engaged in scalping, trading fees play a crucial role. XM is highly regarded in this regard due to its competitive fee structure.

1. Zero Commission Trading at XM

One of the standout features of XM is its policy of not charging any commission on trades. This unique aspect makes XM one of the most trusted and widely used forex brokers globally, attracting a vast number of traders from around the world.

2. XM Leverage

XM offers leverage up to 1:888, which is significantly higher than the industry average, where most brokers cap leverage at 1:500. This high leverage provides traders with greater flexibility and the potential to maximize their trading outcomes.

3. Spread at XM

XM is known for its fast liquidity and excellent execution rates. A key advantage for traders is the low spread offered by XM. For instance, the average spread for the EUR/USD pair is 1.3 pips, which is relatively low compared to the industry average. Additionally, XM frequently runs rebate programs, effectively lowering the actual trading costs for traders who are trading with larger capital.

|

Feature |

Details |

|

Commission |

No commission on trades |

|

Leverage |

Up to 1:888 |

|

Spread |

EUR/USD average spread of 1.3 pips |

|

Additional Benefits |

Frequent rebate programs to reduce actual costs |

XM's fee structure, combined with its high leverage and competitive spreads, makes it an attractive choice for traders, especially those who engage in high-frequency trading or require cost-efficient trading conditions.

Types of Trading Accounts at XM

XM offers four main types of trading accounts designed to cater to the different needs and experience levels of traders. These account types are Micro, Standard, Ultra Low, and Shares accounts. Each of these accounts has unique features that make them suitable for specific trading strategies and goals.

1. Micro Account

The Micro account is designed for beginners or traders who prefer smaller trade sizes. In this account, trading is conducted using micro lots, where 1 micro lot is equal to 1,000 units of the base currency (as opposed to 100,000 units in a standard lot). This allows traders to manage risk more effectively while still trading in a real market environment. The account displays balances in USD, but the smaller lot size (1 micro lot = 0.01 standard lot) makes it easier for traders to control their exposure and risk.

2. Standard Account

Similar to the Micro account, the Standard account allows trading with standard lots. This account type is suitable for traders who are comfortable with larger trade sizes and is ideal for both beginners and experienced traders. The Standard account provides access to all the same features and benefits as the Micro account, but with larger trade sizes.

3. Ultra Low Account

The Ultra Low account is tailored for more experienced traders, particularly those who engage in scalping or other strategies that require tight spreads. This account type offers spreads starting from just 0.6 pips with no commission fees. The minimum deposit required for an Ultra Low account is $50, making it accessible while still offering competitive trading conditions. This account type positions XM competitively against ECN and other reputable forex brokers.

4. Shares Account

The Shares account is primarily designed for traders interested in trading stocks. Unlike the other account types, the Shares account does not allow leverage, and it requires a high minimum deposit of $10,000. This account is intended for traders who prefer a more traditional investment approach, focusing on stock trading without the use of leverage. The minimum trade size is 1 share, and since 1 lot is equivalent to 100,000 units, the actual minimum deposit could be significantly higher depending on the stocks being traded.

|

Account Type |

Features |

|

Micro |

Micro lots (1,000 units), ideal for beginners, manageable risk |

|

Standard |

Standard lots (100,000 units), suitable for most traders |

|

Ultra Low |

Tight spreads from 0.6 pips, no commission, $50 minimum deposit |

|

Shares |

Stock trading, no leverage, $10,000 minimum deposit, 1 share minimum order |

XM offers a variety of account types to cater to different trading preferences, whether you're a beginner looking to manage risk with smaller trades, or an experienced trader seeking low spreads and professional conditions. Each account type is designed to provide a tailored trading experience, ensuring that traders can find the right fit for their strategies and goals.

XM Deposit and Withdrawal Options

XM offers a variety of deposit and withdrawal methods that cater to the needs of traders in Vietnam. The broker supports transactions through popular payment gateways such as online banking, Ngân Lượng, and Debit/Visa cards. Additionally, XM also accepts alternative payment methods like Bitcoin, Neteller, Skrill, and Webmoney. This wide range of options ensures that traders can easily manage their funds using any local bank account.

Deposit Methods

XM provides a range of deposit methods tailored for Vietnamese traders. The inclusion of Ngân Lượng and Local Bank gateways stands out as particularly convenient, allowing for seamless and cost-effective deposits. These methods are especially useful for traders who prefer localized banking options, reducing the hassle and costs associated with international transactions.

Withdrawal Methods

XM offers multiple withdrawal gateways that are both familiar and widely used. Among these, Local Bank and Ngân Lượng are highlighted as the most convenient and cost-efficient by traders. These options provide a straightforward process for withdrawing funds, ensuring that traders can access their earnings quickly and without unnecessary fees.

|

Transaction Type |

Available Methods |

|

Deposit |

Online Banking, Ngân Lượng, Debit/Visa Cards, Bitcoin, Neteller, Skrill, Webmoney |

|

Withdrawal |

Local Bank, Ngân Lượng, Neteller, Skrill, Webmoney |

XM's commitment to providing a wide range of deposit and withdrawal options makes it a practical choice for traders in Vietnam. With the ability to use local payment gateways, traders can efficiently manage their funds, ensuring a smooth and secure trading experience.

Customer Support Services at XM

XM offers a comprehensive customer support system that spans across the globe, catering to traders in more than 30 languages, including Vietnamese. This multilingual support ensures that traders from various regions can easily access information and resolve their queries in their preferred language. The XM support team operates from Monday to Friday, with working hours typically set to match the standard business hours of each region.

Global Live Chat Support

One of XM's standout features is its live chat support, available in over 30 languages. This service allows traders to receive real-time assistance with any trading-related inquiries or issues. Whether you need help navigating the platform, understanding your account, or resolving technical problems, the XM support team is ready to assist.

Forex Education Initiatives

XM places a strong emphasis on education, offering free webinars and online classes to enhance traders' understanding of the forex market. These educational resources are conducted by experienced professionals and cover a wide range of topics, from basic forex concepts to advanced trading strategies. The online classes are accessible multiple times a week and are designed to cater to traders of all experience levels.

|

Support Feature |

Details |

|

Live Chat Support |

Available in over 30 languages, including Vietnamese |

|

Support Operating Hours |

Monday to Friday, standard regional business hours |

|

Educational Resources |

Free online classes and webinars by expert traders |

XM's commitment to customer support and education reflects its dedication to providing traders with the tools and knowledge they need to succeed. Whether you're a beginner or an experienced trader, XM offers the resources necessary to enhance your trading journey.

Conclusion

With the information provided, XM stands out as a reliable and trustworthy trading platform, making it a solid choice for traders looking to invest and generate profits. Over its 10-year history, XM has shown impressive growth and built a substantial user base, highlighting its professionalism and strong reputation in the industry.

If you have any further questions, feel free to leave a comment below, and we’ll be happy to assist. If you found this article helpful, please share it with others who might benefit from this knowledge!