OFP Funding is a brokerage firm that offers a range of financial services to its clients. This article will explore the different aspects of OFP Funding and how it caters to its clients' needs.

Company Overview

OFP Funding was established in 2015 and is headquartered in Cyprus. It provides financial services in various areas, including forex trading, commodities, indices, and shares. The company offers a range of account types, including demo, standard, and professional accounts. OFP Funding is regulated by the Cyprus Securities and Exchange Commission (CySEC).

Trading Platforms

OFP Funding provides its clients with the MetaTrader 4 (MT4) platform, which is widely used in the forex trading industry. This platform is user-friendly and offers a range of tools, including technical analysis, real-time quotes, and customizable charts. Additionally, OFP Funding offers the MetaTrader 5 (MT5) platform, which is a more advanced version of the MT4 platform. The MT5 platform includes additional features such as more advanced charting capabilities, more timeframes, and the ability to trade in futures and options.

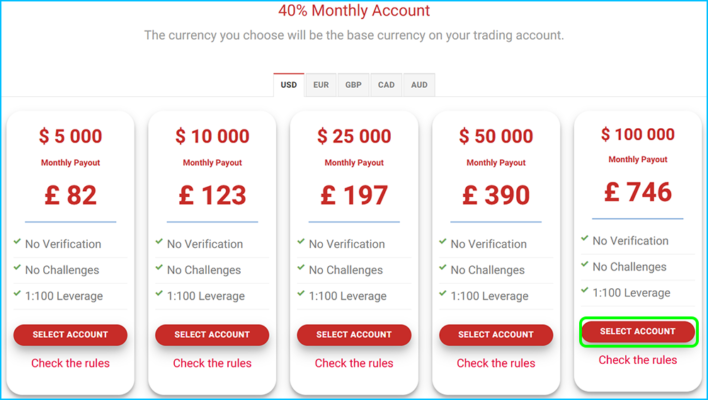

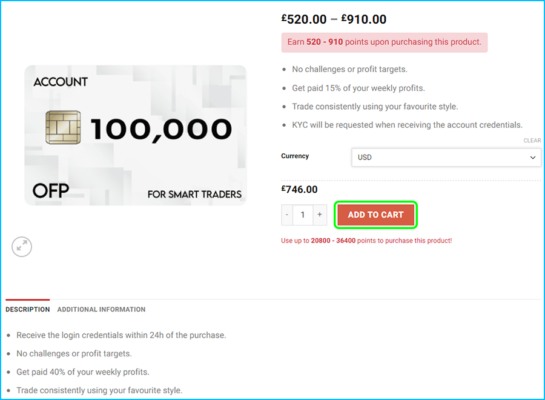

Account Types

OFP Funding offers three types of trading accounts: demo, standard, and professional. The demo account is designed for novice traders who want to learn about forex trading without risking their capital. The standard account is suitable for experienced traders who want to trade with real money. The professional account is designed for institutional clients who require a more advanced trading environment.

OFP Commission and Fee

In addition to its trading offerings, OFP also provides its clients with a range of features and services such as tight spreads, fast execution, a variety of account types, educational resources, and more. One of the key aspects that traders often consider when choosing a broker is the commission and fees associated with trading.

Commission

OFP charges a commission on trades for its ECN account type, which is a popular option for experienced traders who require a faster execution speed and lower spreads. The commission charged on ECN account trades starts from $5 per lot, which is competitive when compared to other ECN brokers in the industry. However, for those who do not want to pay a commission on trades, OFP also offers a Standard account type which has no commissions but instead, spreads are marked up slightly.

Fees

In terms of fees, OFP does not charge any deposit or withdrawal fees for bank transfers. However, for those who prefer using credit or debit cards, a fee of 2.5% will be charged on deposits. OFP also charges an inactivity fee of $25 per month for accounts that have been inactive for more than 6 months. This fee is relatively high compared to other brokers in the industry and can be avoided by logging in to the account at least once every 6 months.

Deposit and Withdrawal Method with OFP

In this section, we will explore the different deposit and withdrawal methods offered by OFP Markets, as well as any fees or restrictions associated with these methods.

Deposit Methods

OFP Markets offers several deposit methods, including credit/debit cards, bank wire transfers, and e-wallets. Clients can choose the deposit method that best suits their needs and preferences. The minimum deposit amount varies depending on the deposit method, ranging from $10 for e-wallets to $50 for bank wire transfers.

Credit/Debit Cards OFP Markets accepts deposits via major credit/debit cards such as Visa, Mastercard, and Maestro. Deposits via credit/debit cards are process instantly, and clients can start trading immediately after the deposit is credit to their account. The minimum deposit amount for credit/debit cards is $50.

Bank Wire Transfer OFP Markets also accepts deposits via bank wire transfer.

Deposits via bank wire transfer can take 2-5 business days to process, depending on the client's bank and location. The minimum deposit amount for bank wire transfers is $50.

E-wallets OFP Markets accepts deposits via popular e-wallets such as Skrill, Neteller, and WebMoney. Deposits via e-wallets are process instantly, and clients can start trading immediately after the deposit is credit to their account. The minimum deposit amount for e-wallets is $10.

Withdrawal Methods

Clients can withdraw funds from their OFP Markets trading accounts using the same methods used for deposits. Withdrawals are process within 24 hours on business days, and clients can expect to receive their funds within 3-5 business days, depending on the withdrawal method and client's bank.

Credit/Debit Cards Withdrawals via credit/debit cards are process within 24 hours on business days. However, it may take an additional 3-5 business days for the funds to appear in the client's bank account.

Bank Wire Transfer Withdrawals via bank wire transfer can take up to 5 business days to process.

The minimum withdrawal amount for bank wire transfers is $100.

E-wallets Withdrawals via e-wallets are process within 24 hours on business days. Clients can expect to receive their funds within 1-3 business days, depending on the e-wallet service provider.

Fees OFP Markets does not charge any deposit or withdrawal fees. However, clients may incur fees charged by their banks or e-wallet service providers. It is recommended that clients check with their banks or e-wallet service providers for information on any applicable fees.

Overall

While OFP's commission and fees are competitive, traders should always do their own research to find the best broker that suits their individual needs. It is important to consider the commission and fees alongside other factors such as trading platforms, trading conditions, customer support, and more.

Trading Conditions

OFP Funding offers competitive trading conditions to its clients. The company offers variable spreads, which means that the spreads can change depending on market conditions. The minimum deposit required to open a standard account is $250, and the minimum deposit required to open a professional account is $10,000. The company offers leverage of up to 1:400 for forex trading.

Customer Support

OFP Funding offers customer support via phone, email, and live chat. The company's website also features an extensive FAQ section that answers common questions about the company's services.

Conclusion

OFP Funding is a reliable and trustworthy brokerage firm that offers a range of financial services to its clients. The company's trading platforms, account types, and trading conditions are competitive, making it an attractive option for traders of all levels. Additionally, the company's customer support is excellent, providing traders with the assistance they need to succeed in the forex trading industry. Overall, OFP Funding is a reputable brokerage firm that can provide traders with the tools and resources they need to achieve their trading goals.

FAQ's

What is OFP Brokerage?

Brokerage is a trading platform that offers online trading services in the forex, CFD, and commodity markets.

Is OFP Brokerage a regulated broker?

Yes, It is regulated by the Financial Conduct Authority (FCA) in the UK.

What trading platforms are available on OFP Brokerage?

OFP Brokerage offers traders the popular MetaTrader 4 (MT4) trading platform, as well as a web-based platform that is accessible from any device with an internet connection.

What are the account types available on OFP Brokerage?

OFP Brokerage offers three types of accounts: Standard, Pro, and VIP. Each account has different minimum deposit requirements, spreads, and commissions.

What are the deposit and withdrawal options available on OFP Brokerage?

OFP Brokerage offers a variety of deposit and withdrawal options, including bank transfers, credit/debit cards, and e-wallets such as Neteller and Skrill.

What are the trading instruments available on OFP Brokerage?

OFP Brokerage offers trading in a variety of instruments, including forex, stocks, indices, commodities, and cryptocurrencies.