Absolute Markets is a multi-asset trading broker. Based in Saint Vincent and the Grenadines and SVGFSA-regulated, the relatively new brokerage offers a bespoke trading platform, plus the industry-renowned MT4 terminal. Day traders can invest in 500+ instruments including forex, stocks and indices. This 2023 review will cover platform features, login security, account options, fees and more. Find out what our expert traders made of Absolute Markets.

Company Details

Absolute Markets LLC was founded in 2021 by a trio of ex-traders. The vision of the company is to make investing easy and accessible across the globe. The brand is a good option for beginner traders looking for a hassle-free and straightforward investing environment.

Absolute Markets is registered in Saint Vincent and the Grenadines and regulated by the Financial Services Authority (SVGFSA).

The broker has 5345+ active traders and offers investing services in over 170 countries.

How to Stay Away From SCAM

This Absolute Markets review is a must if you don’t want to lose your money to a scam. Read carefully and take notes.

| Broker status: | Unregulated Broker |

| Regulated by: | Unlicensed Scam Brokerage |

| Scammers Websites: | absolutemarkets.com |

| Blacklisted as a Scam by: | N/A |

| Owned by: | N/A |

| Headquarters Country: | Saint Vincent and Grenadines |

| Foundation year: | 2021 |

| Supported Platforms: | MT4 |

| Minimum Deposit: | $50 |

| Cryptocurrencies: | BTC, ETH, XRP |

| Types of Assets: | Forex, stocks, commodities, indices, cryptocurrencies |

| Maximum Leverage: | 1:1000 |

| Free Demo Account: | Yes |

| Accepts US clients: | Yes |

Is Absolute Markets a Secure And Regulated Platform?

Absolute Markets broker was established in 2021 in Saint Vincent and Grenadines. On the website, you can find the information that the company was created by three partners with more than ten years of experience. On the other hand, the names and portfolios are non-existent. The website overall looks good and simple. It contains the most relevant information about the company and its services until you start digging deeper.

We’ve found no trace of this broker with FCA, ASIC, or BaFin. However, they claim to be licensed by the FSA of Saint Vincent and the Grenadines. Why is this ridiculous? This financial authority can regulate no broker since they’re not in charge of Forex, CFD, binary options, or any other trading firm.

The Absolute Market broker was established in 2021. The broker claims to be FSA-licensed, but this regulator doesn’t provide Forex or CFD regulations.

How Unsafe Is An Unlicensed Broker?

The regulation is one of the first things you should check before signing in with any company, let alone when you’re investing money. Regulated companies take many measures to protect their members. For example, the client’s money must be segregated from the company’s money. It is essential to mention negative balance protection, which means you cannot lose more money than you initially invested.

And this is all a reason why unlicensed brokers are not safe. There are no measures and no rules.

Trading Platforms

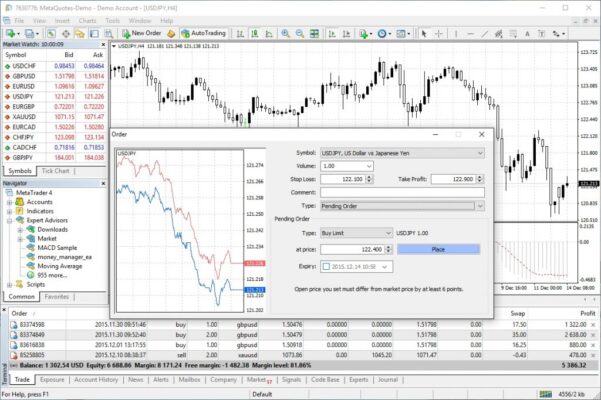

Absolute Markets offers two trading platforms; a proprietary WebTrader and MetaTrader 4 (MT4). The bespoke web-based platform can be used directly through an internet browser. The MT4 terminal is available to download to Windows and Mac devices and is also accessible via a web-based profile.

Both platforms are suitable for beginners, though we would recommend using the demo account first to learn the features and functionality.

MetaTrader 4

- Nine timeframes

- Multilingual interface

- Fully customizable charts

- One-click order execution

- Three order execution types

- MQL4 programming language

- 30+ built-in technical indicators

- Direct access to Expert Advisors and automated trading systems

WebTrader

- View full trading history

- 100+ technical indicators

- 0.01 second trading execution

- TradingView charting software

- Follow trading signals with live market suggestions

While using the proprietary trading platform, our experts found the software is easy to use, though customization and advanced trading tools are limited.

Absolute Markets Range of Trading Instruments & Markets

Customers can trade in all major markets, including:

- Currency pairs – EUR/USD, GBP/USD, AUD/JPY

- Commodities – gold, silver, oil

- Indices – NASDAQ, FTSE100, DAX30

- Shares – Amazon, Tesla, Apple

- Cryptocurrencies – BTC, ETH, XRP

Absolute Markets Broker – Countries Of Service

Our research has shown that the broker mainly operates in:

- US

- South Africa

- UK

- India

Leverage And Spreads

Spreads & Fees

Fees vary depending on account type and trading instrument. The Micro Account and Variable Account incur zero commissions while spreads start from 1.4 pips on the Micro Account and 1.2 pips on the Variable Account. Real-time spreads can be viewed within the broker’s trading interface.

Both ECN profiles apply a commission-based fee structure. This is $10 per round turn lot. Day traders can also expect spreads from as low as 0 pips during periods of high liquidity, similar vs Pepperstone.

Dormant accounts will be liable for a $5 monthly fee after six months of inactivity. Swap fees apply for positions held overnight.

Leverage

For all the accounts, leverage goes up to 1:1000. This extremely high leverage is insane and dangerous. Because it can lead to more significant losses, it has been restricted in many jurisdictions. If a broker is regulated, you cannot have leverage higher than 1:50. The spread starts at 2.2 pips, while the industry average is 1.5 pips.

Absolute Markets Deposit, Withdrawal Methods, And Fees

The company has quite an unusual offer of payment methods, not allowing customers to use their credit cards for withdrawals. This goes against AML policy, where the payment method for deposit and withdrawal should be the same.

What Payment Methods Does The Broker Accept?

Absolute Markets offers a wide range of methods. Clients can deposit via:

- Visa,

- Mastercard,

- Wire transfer and

- Cryptocurrency

The only problem is that the company is not allowing withdrawals via card. Why? Getting a chargeback on a wire transfer is almost impossible, which is amazing combined with virtually irreversible crypto transactions. Absolute Market has scams written all over the place.

Absolute Markets Bonuses and Referrals Program – As A Method Of Fraud

Bonus is encouraging, but don’t fall for this. The company is offering bonuses while failing to present terms in the Terms and Conditions section. Accepting a bonus like that means you will be asked to reach an unrealistic turnover before making a withdrawal request. Please note that such promotions are banned in regulated companies.

FAQ's

What Is Absolute Markets ?

Absolute Markets is an unlicensed broker established in 2021 in Saint Vincent and Grenadines.

Is Absolute Markets a Scam Broker?

Yes, the company is not registered with any reliable financial authority.

Is Absolute Markets Available in the United States or UK?

They are available in the UK and the US, both without a valid regulation.

Does Absolute Markets Offer a Demo Account?

Absolute Market is offering a Demo account, but when we tried to test it, it didn’t work.