Who should sign up with Fidelcrest?

If you want a chance to trade with a $1 million account, Fidelcrest is one of the only reputable prop firms who will give you that opportunity immediately after passing your two-step evaluation.

If that’s too much capital for you at this time, on the opposite end of the spectrum Fidelcrest offers the most affordable $10K account in the industry. In between, there are enough options that you’re destined to find the perfect account.

And if you’re a crypto trader, Fidelcrest offers more crypto pairs to trade than any other prop firm.

Beginners and bargain hunters alike should take advantage of Fidelcrest’s current promotion, which offers either a free second chance should you fail your evaluation, or double your capital should you succeed.

Fidelcrest can get you trading real capital with a funded account as fast as just about anyone in the industry, and offers the highest profit sharing schemes to boot.

About Fidelcrest

Fidelcrest is a globally operating proprietary trading firm with headquarters in Nicosia, Cyprus, and was founded in 2018. The company gives ordinary yet skilled traders that have met specific requirements access to accounts with real funds up to $400,000, thus, enabling them to make a difference in their lives.

According to the site of the company, the Fieldcrest management team is comprised of Forex traders and professionals with more than ten years of experience in the niche, working for global brokerage companies. However, there is no further information about who owns and runs the company, which is uncommon considering the typical transparency we are used to seeing in the niche.

Fidelcrest states that its mission is to help retail clients make steady gains over long periods. With more than 6,000 active traders from all across the world, Fieldcrest is considered among the most prominent trading prop firms and funded trader account providers.

The company offers a wide range of account size options designed to suit traders with various levels of expertise and needs.

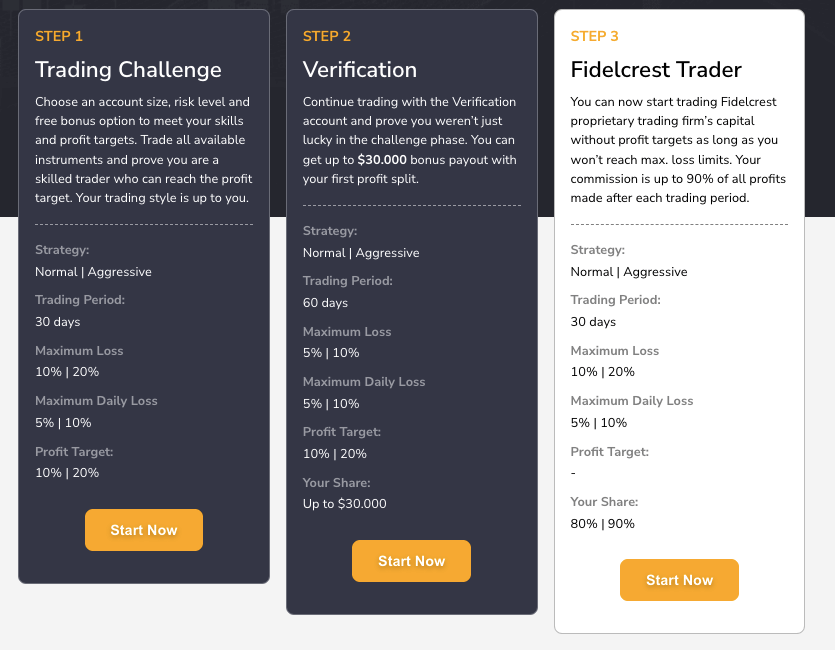

The Fidelcrest trading challenge starts with an evaluation period where you will trade with a demo account and upon predefined trading rules. Once they have passed the challenge within the required trading period, account holders can receive funding and start trading over 1,000 trading instruments.

All holders of Fidelcrest accounts should know that the company has strict rules described in their Trader Agreement. Violation of any of these rules would result in account suspension.

Who should NOT sign up with Fidelcrest?

You know your trading style. If you are dependent on a few make-or-break trades to hit your profit targets, you might pass the Trading Challenge, but you might have trouble with the Verification Stage. Due to tighter trading parameters, the Verification Stage rewards cautious traders who can book consistent profits.

If your style is not compatible with the 5–10% max loss parameters in the Verification Stage or you’re not confident in your risk management skills, you should find a firm with looser trading guidelines. In other words, if you take excessive risks with your capital, Fidelcrest probably won’t give you any of theirs.

Fidelcrest Basics

Fidelcrest origin story

It was formed in 2018 by a group of experienced traders who wanted to provide capital to retail traders who had talent but needed further funding.

Fidelcrest the proprietary trading company was established at the same time as Fidelcrest Proprietary Trading Company. That sounds redundant, but Fidelcrest Proprietary Trading Company (capital letters) has the actual capital (hence the capitals?) and issues the real money to traders once they pass the evaluation and become funded. The lowercase Fidelcrest proprietary trading firm handles the Trading Challenge and the Verification stages of the evaluation process.

How does Fidelcrest work?

Fidelcrest works exactly like other prop firms. For a fee, you can audition to receive a Fidelcrest funded account that could give you as much as $1 million of Fidelcrest capital for you to trade. Whatever profits you make you will split with Fidelcrest, keeping either 80% or 90% for yourself. If you lose money, Fidelcrest will pay off your tab, but probably won’t keep you around.

To get started, pick an account size, pay the one-time fee, and you’ll begin the Trading Challenge. If you meet your trading objectives, you’ll advance to the Verification Stage. If you pass the Verification Stage, you’ll receive a bonus for your efforts and become a Fidelcrest Funded Trader.

As a Fidelcrest Funded Trader, you’ll receive the amount of capital that you selected when you chose an account size (or double if you took advantage of the promotion). Make some successful trades and you’ll receive your first profit split. Continue to have success and eventually you’ll be placing a downpayment on a yacht.

How much does Fidelcrest cost?

Fidelcrest only charges a one-time set-up fee, so you never have to worry about recurring charges.

Normal Account

| Account Size | One-time Fee |

| $10,000 | €99 |

| $25,000 | €249 |

| $50,000 | €449 |

| $150,000 | €649 |

| $250,000 | €999 |

| $500,000 | €1,799 |

| $1,000,000 | €2,899 |

Aggressive Account

| Account Size | One-time Fee |

| $10,000 | €149 |

| $25,000 | €349 |

| $50,000 | €549 |

| $150,000 | €999 |

| $250,000 | €1,599 |

| $500,000 | €2,899 |

Getting Funding From Fidelcrest

Fidelcrest offers essentially 4 different account types for traders to choose from. This starts with the Micro accounts. If you choose to trade the Micro accounts, you’ll have a range of $5000-$20,000 to manage, depending on which funding option you decide on. These come with a one off fee of course, starting at just $99 making it one of the cheapest firms in the market.

They also offer Pro accounts, which start at $50,000 and work all of the way up to $400,000 under management. This is absolutely huge and as far as I am aware, the largest account you can purchase from a prop firm in the world right now. Other companies like 5% will scale your capital up into the millions, but in terms of starting account balance, this will be the most you’ll find!

Both of the account options come with 2 options, either Normal or Aggressive. They’re fairly self explanatory in nature, if you’re a trader that has large PnL swings, typically larger drawdown but typically larger gains, you may want to opt for the Aggressive account option as this type of trading behaviour is allowed. Your profit share goes up from 70% to 80% on the Aggressive option, with maximum drawdown increased to 20% and profit target also increased to 20%. The only drawback here is that compared to just the Normal account type, you will have to pay a higher initial fee for the account.

What Makes Fidelcrest Different From Any Other Prop Firm?

Fidelcrest is very similar to other leading prop funds in many ways and shares a lot of common traits with FTMO. However, what really sets Fidelcrest apart is just the huge amount of capital you are able to obtain if you pass the trading requirements.

They offer a maximum initial funding of $400,000! Now this size of account is going to cost you $1,499 in order to take the challenge, which you might not even pass – so it’s certainly not a guaranteed get rich scheme but for profitable and consistent forex traders it is a ticket to the big leagues.

Not only is $400,000 of trading capital accessible, Fidelcrest, much like 5%ers, have a capital scaling program that you can be a part of if you are consistently making returns on your funded account.

The scaling planis fairly straight forward, you should know that they have the lowest profit target in the industry for MicroFX. You need to achieve a 15% gain on your capital, within 3 months – with each of those 3 months being profitable. This is an average return of 5% per month and consecutively green months. Should you be able to achieve this, they will increase your capital by 25% every 3 months. This is an insane rate of growth and is currently capped at a staggering $800,000!

It’s important to note that on the website it mentions the fact that the largest account currently being traded by retail forex traders is $400,000, meaning no one has managed to scale the largest account up to the full $800,00 yet!

Is Getting Fidelcrest Funding Realistic?

When looking at getting funded with prop firms, it can sometimes feel too good to be true so it’s important to understand how realistic it actually is to achieve the targets being set out by these companies.

As far as industry standards go, Fidelcrest is very competitive in regard to the levels of trading standard required to actually pass the challenge and verification stage.

If we take a look at the $50,000 Pro Account for $349. We can get a sense of the conditions we are trading with. You can trade on MT4 or MT5 with a range of trading brokers and most importantly up to 1:100 leverage. This is in comparison to BluFx which only offers 1:3 leverage. Making it harder for some traders to actually hit their profit targets.

Comparing the program information here

To some of the other prop firmslike MyForexFunds– it’s fairly standard.

I think this is extremely achievable for the majority of profitable forex traders and the ability to use any broker. With any trading instruments means your performance can’t be hindered!

The 3 step process for getting funded certainly seems very achievable for a profitable forex trader. Initially you have a 30 day trading period to reach a 10% profit target. With a maximum loss of 10% (5% maximum daily loss). At this point, you fee is refunded and you move onto the next stage. You will again have 30 days to reach a profit of 10%. With a maximum loss of 5% (5% maximum daily loss) – during this stage you will keep 40% of the profit made. Then you’re onto your funded account, where there is no fixed profit target, you just keep trading!

If you aren’t a fan of having to do a challenge, then a verification, there are companies offering instant funding. For this, I would recommend checking out DT4X Traderand MyForexFunds– if you’re in a hurry to get trading!

Customer Support Team

You can reach out to the Fidelcrest customer support in various channels.

The quickest way to get your issue or answer addressed is through live chat. It is open 24 hours on business days, but they might reply to your chat request via email on some occasions. Unfortunately, the live chat doesn’t work on weekends.

According to the information on the website, the average response time is 1 minute.

Clients who prefer other ways of communication can opt for email, social media, and a ticketing system.

Fidelcrest Review Summary

The prop firm offers some of the most flexible terms on the market and one of the highest profit-sharing schemes. It gives traders the freedom to buy and sell all types of instruments and apply advanced trading techniques.

The different tiers of the Fidelcrest funded trader accounts make it a suitable choice for all types of market participants, including beginners, professional traders, risk managers, and more.

Fidelcrest has a disadvantage compared to other funded trading accounts. With Fidelcrest, you have to trade the same instruments in all phases. The problem is that, based on their account management section in the knowledge base (under how is my account monitored), you need to use a new account with each trading period/phase. This is complicated, and it can happen that the broker in Phase 2 does not support the trading instrument you used in Phase 1. As a result, you face a problem since the terms and conditions require you to trade the same instruments, which you can not do.

While its online reputation isn’t necessarily impeccable, with users expressing frustration mostly about customer support issues and strict and rigorous validation process, there are means to believe Fidelcrest is worth trying.

FAQ

Is Fidelcrest legit?

Although it is hard to find any information regarding the management of Fidelcrest, the company is legit. It is owned and operated by Fidelcrest Ltd, with a registered office in Nicosia, Cyprus. Fidelcrest has been around since 2018, and its operations hadn’t raised any major red flags so far.

How does Fidelcrest work?

The company offers funded trader programs that require completing three phases, a trading challenge, a funded verification procedure, and a professional account opening. On each step, you should make sure to comply with the rules and requirements. If successful, you will be granted funding with a profit share mechanism of 70% or 80%.