Our Plus500 review includes everything from the Webtrader online trading platform, to the mobile app and fees. Whether you are looking to login and trade Bitcoin, ripple or Oil, or you just need details on the demo account and minimum deposit, we cover everything in this detailed review.

Read why you can trust DayTrading.com reviews.

Plus500 is a leading online Contract for Difference (CFDs) trading platform that is owned by a holding company called Plus500 Ltd.

The company is listed on the Main Market of the London Stock Exchange (LON:PLUS). Operating through multiple different subsidiaries:

- Plus500UK Ltd

- Plus500CY Ltd

- Plus500SG Pte Ltd

- Plus500SEY Ltd

- Plus500AU Pty Ltd

Making the brand synonymous with reliability and compliance.

This is largely due to the fact that Plus500 (or subsidiaries) are regulated in several different jurisdictions around the world.

In addition to being regulated around the world, Plus500 is also an active sponsor of professional Soccer and Rugby teams.

The firm were previously the official sponsor of Club Atletico de Madrid for seasons 2015-2022. They also added Legia Warsaw and Atalanta to their list during 2020.

Regulation & Reputation

Since its inception in 2008, Plus500 has earned a reputation among traders in the online community as being reliable and trusted. Plus500 Ltd is listed on the Main Market of the London Stock Exchange, which also helps to bolster the broker’s reputation as being financially stable.

In terms of regulatory oversight, Plus500 subsidiaries are regulated by several regulatory agencies:

- Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909).

- Plus500CY Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (Licence No. 250/14).

- Plus500AU Pty Ltd, ACN 153 301 681, AFSL # 417727, issued by the Australian Securities and Investments Commission is authorised to issue these products to Australian residents.

- Derivatives issuer licence in New Zealand, FSP #. 486026 authorises them to issue these products to New Zealand residents.

- Plus500AU Pty Ltd, is also an authorised Financial Services Provider in South Africa, FSP 47546.

With subsidiaries as regulated entities under the UK’s FCA, ASIC in Australia and CySEC, Plus500 is able to work with traders from Australia, Europe and the UK. Clients can therefore take advantage of the rights and benefits of being protected under the Financial Services Compensation Scheme (FSCS) and Investors Compensation Scheme.

The company is also a licensed investment firm in Estonia under the oversight of the country’s Financial Supervision Authority (FSA).

For full details of the protection these schemes offer, visit the website.

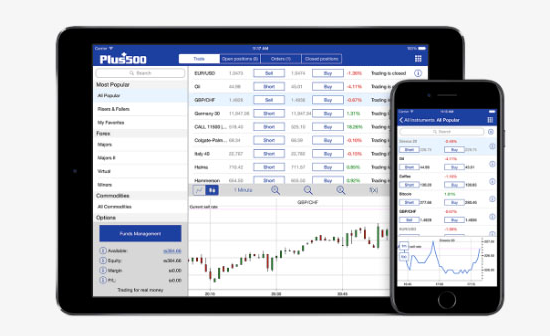

Trading Platforms

Although Plus500 uses a proprietary trading platform, the trading platform (Webtrader) is able to cater to the different needs of the broker’s international clientele base, as it is available across several different versions.

This Plus 500 review included multiple versions of the platforms.

Retail and professional accounts operate on the same platform.

This creates pros and cons but with advanced research tools next to the ability to execute trades in a user friendly way the platform performs well.

The layout is clean and crisp, with clear ‘Buy’ and ‘Short’ buttons, and simple set up of stop and limit orders.

For those who wish to trade directly from the internet, there is a web-based version of the trading platform which can be accessed with any web browser. There is no integration with MT4 at present.

Up to date market information and news is available via the platform.

The key difference between the Webtrader trading platform and the platforms provided by other brokers in the industry is the fact that Plus500 trading platforms work seamlessly with each other.

Plus500 has also introduced a bespoke platform, Plus500 Invest.

Clients can buy, sell and hold more than 1,400 instruments stocks on major global exchanges in the US, UK and Germany. There are zero deposit and withdrawal fees or custody charges with this platform.

The mobile-friendly platform comes with a clean interface and with straightforward buy and sell orders.

Mobile Trading

A mobile version of the trading platform is also available to traders who wish to trade the markets using just their smartphones or mobile devices.

Provided free of charge, the mobile trading app can be downloaded directly from Google Play store or Apple App Store.

The mobile app is fully functioning, and offers all the trading options that the web based version does, including CFDs on stocks and shares. It is a single click download, and trading via the app is quick and easy.

Look and feel between mobile and web based platforms is kept the same, making transition between the two very easy.

Both Android and iOS versions retain all the same low trading fees, spreads and rates etc, and any trading portfolio is retained across all platforms.

How Does Plus500 Work?

So what is Plus500 all about, and how can you trade with them? The official guide video below, runs you through exactly how to trade on their platform.

Whether you are using the web platform, an android device or your iPhone, the process is the same.

The video explains how Plus500 works (and how CFDs work), so you can judge if they are right for you.

Remember also, that a demo account gives you the option learn how Plus500 works, without having to risk real money.

Trading Accounts

Plus500 has only provided one type of trading account, a standard trading account. The standard trading account requires a minimum deposit of $100 to open.

With this recent enhancement, existing account holders see a range of benefits. However they will be subjected to a higher minimum trade volume.

Apart from the standard trading account, Plus500 has also provided a free unlimited demo account which potential clients can use to test out the performance of the trading platform and develop a trading strategy.

Although there is only one trading account, there is provision for traders to be classed as “professional” rather than “retail” clients. The differences include increased leverage (1:300) and fewer restrictions on margin.

The downside however, is that regulatory protection is reduced for ‘Pro’ accounts. Visit the website to apply, or see if you will be eligible for a professional account.

Assets & Instruments

Traders will be pleased to know that there are more than 2000 instruments to choose from using CFDs. These underlying assets include major classes such as currency pairs, cryptocurrencies (subject to regulations), commodities, ETFs, options and stocks.

Available leverage is 1:30 (Higher for professional accounts). This will vary based on the market traded.

Stocks and equities can be traded whenever the relevant stock exchange is open, e.g. New York, London, Hong Kong etc.

Where available, cryptocurrency leverage is capped at 1:2 by the regulator, but assets like Bitcoin, Ripple and Litecoin are all available to trade with tight spreads. (Note that in the UK, CFDs are not available on Cryptocurrencies). Plus500 also offers CFDs on the Crypto 10 index from BITA.

Customer Support

While the support service at Plus500 is available 24/7, it is only available through email or live chat. So although their website is available in 32 different languages, there is no telephone support.

Deposit And Withdrawal

Available payment and withdrawal methods at Plus500 include Credit/Debit Card (Visa or MasterCard), PayPal, POLi, Google Pay, PayNow, Skrill (Moneybookers), or Bank Transfer. Any of these can be used to fund an account.

The minimum deposit is $100.

The same methods can be used for making deposits and withdrawals. To withdraw, the processing time is 3 business days. It should be noted that all withdrawal methods have a minimum amount threshold and you can only withdraw through the method that you used initially for making your deposit.

There are currently no withdrawal fees or commissions at Plus500.

Is Plus500 Best For Day Trading?

Without a doubt, Plus500 operates with a high standard of efficiency and reliability. Their digital Webtrader trading platform, is proprietary and able to perform the job of executing trades quickly. In addition, there is a wide range of assets for you to choose from to trade with at home.

As a day trader, it is important that you can execute as many trades as needed within a short time frame. With the huge asset index, you will be able to do just that, without difficulties.

In addition, the fact that you can open and close a CFD position at any time during trading hours, means you can review and amend your positions and investing portfolio however you need to.

Our Plus500 review focussed on short term trading, and Plus500 is suited to trading over this timescale, not long term.

The demo account offers the opportunity to learn the platform, backtest strategies with historical data and check the platform layout suits each trader.

Compare Plus500 vs eToro

| Broker | Minimum Deposit | Regulator | MT4 |

|---|---|---|---|

| Plus500 | $100 | FCA, CySec, ASIC | No |

| eToro | $200 | FCA | Yes |

It seems Plus500 compares well to eToro, with a larger range of markets and far more research and analysis tools. eToro tends to cater to more casual traders – perhaps who’s time is limited. Copy Trading is their big feature – but they do offer fractionally smaller spreads (trading costs).

However, delivers a superior service for more involved traders, and also has a lower minimum deposit and more advanced trading platform.

| Broker | FTSE | Oil | EUR/USD |

|---|---|---|---|

| Plus500 | Dynamic | Dynamic | Dynamic |

| eToro | 1 pt (var) | 5 pts | 3 pips (var) |

You can see a more detailed comparison on our dedicated page: Plus500 vs eToro

Awards

Accepted Countries

Based on local restrictions, Plus500 is not available for citizens of – to mention a few – Belgium, Iran, United States, Canada, Zimbabwe, Nigeria, Cote D’Ivoire, Cameroon, Thailand, India, Indonesia, Brazil, Egypt, Pakistan, France, Cayman Islands, Philippines. Check with the Customer Support if you are allowed to trade on their platform.