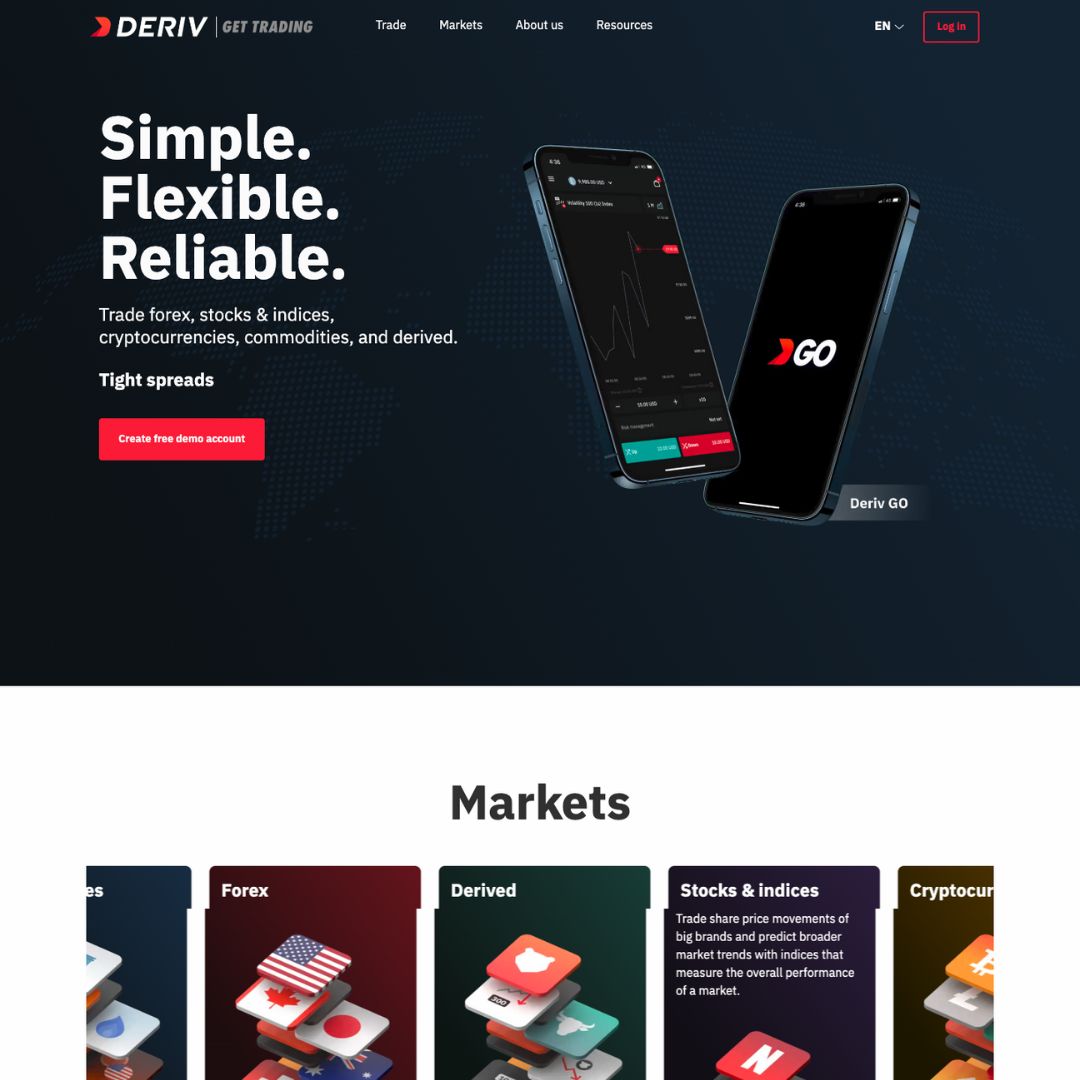

Are you looking for a trustworthy and innovative trading platform? Look no further than Deriv, a rebranded version of the renowned Binary.com. With over 20 years of experience and a strong reputation in the industry, Deriv offers a secure and user-friendly environment for both experienced and beginner traders.

This review delves into the unique features of Deriv, exploring its advantages and addressing any potential concerns you might have.

Why Choose Deriv?

- Legitimacy and Trust: Deriv is a legitimate and trusted platform, operating for over 20 years and earning multiple awards for its services. Its transformation from Binary.com further solidifies its reliability.

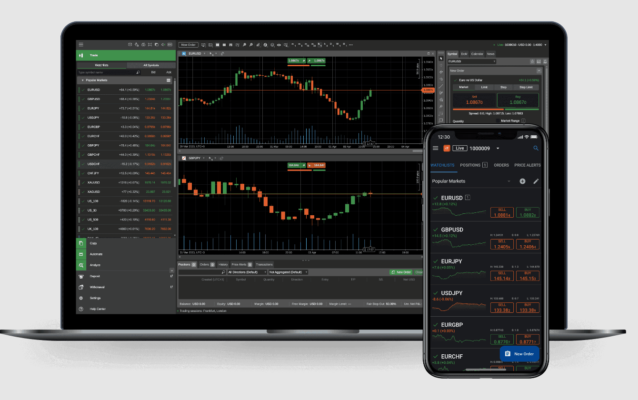

- Innovation and User-friendliness: Deriv boasts a unique and user-friendly DMT5 platform, designed for a seamless trading experience.

- Diverse Trading Options: Deriv offers a wide array of trading instruments, including forex, CFDs, and synthetics, to cater to different trading styles and preferences.

- Competitive Spreads and Fees: Enjoy competitive spreads and fees compared to other platforms, allowing you to maximize your trading profits.

- Focus on Client Satisfaction: Deriv prioritizes its clients' needs, providing excellent customer service and educational resources to support your trading journey.

What Is Deriv?

Regulation

How To Open a Deriv Real Account

- Currency Selection

- Providing detailed personal information including first name, last name, date of birth, and mobile number

- Inputting accurate address details matching those in your proof of address

- Thoroughly reading and consenting to the terms and conditions

- Instantly processing the deposit of a minimum amount of $5 to commence trading with preferred instruments.

Deriv Trading Platforms

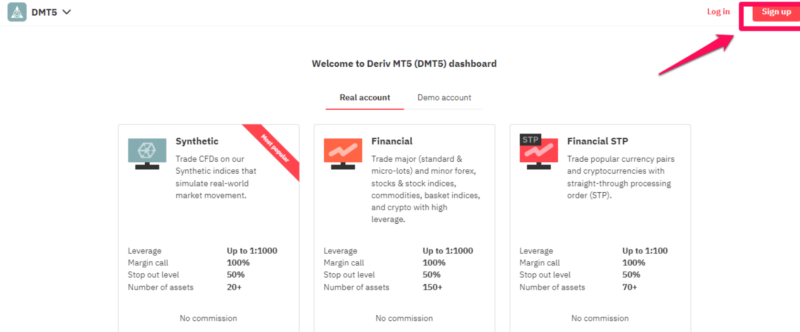

Deriv Account Types & Features

Synthetic Account:

- Leverage: 1:1000

- Margin call: 100%

- Stop out level: 50%

- Minimum deposit: $5

- Commissions: None

Financial Account:

- Leverage: 1:1000

- Margin call: 100%

- Stop out level: 50%

- Commissions: None

Financial STP Account:

- Leverage: 1:1000

- Margin call: 100%

- Stop out level: 50%

- Commissions: None

- Number of Assets: 150+

Trading Instruments And Market

Margin Trading:

Forex:

Synthetic Indices:

Stock Indices:

Cryptocurrency:

Commodities:

Basket Indices:

Spread, Commission & Leverage

Deriv Deposit And Withdrawal

Deriv offers traders a variety of funding methods, such as wire transfers, credit/debit cards, e-wallets, and cryptocurrencies. Deposits and withdrawals typically take one business day, except for bank or money transfer services, which might take longer.

The minimum deposit on Deriv starts at $5, but this amount may vary depending on the payment method used. Notably, there is no minimum deposit requirement for cryptocurrency transactions.

Here's a breakdown of minimum deposit amounts and processing times for different payment methods:

- Bank Wire Transfer: Minimum deposit begins at $5, taking 1 or 2 business days.

- Credit/Debit Card: The minimum deposit amount is $10, with instant processing for deposits, while withdrawals take a business day.

- E-wallets (Skrill, Neteller, PaySafe, Fasapay, WebMoney): Accessible with varying minimum funding amounts.

- Cryptocurrency: No minimum deposit requirement.

Customer Support

Each funding method may have different minimum amounts and processing times, providing traders with flexibility in managing their accounts based on their preferred payment options.

Conclusion

In summary, we've highlighted the crucial aspects in this review. Don't hesitate any longer—seize the opportunity to open a Deriv account today and begin trading confidently.

The registration process is fast and straightforward, granting you access to an array of tools and resources essential for success. Embrace this chance to steer your financial future in the right direction—register now and take charge!